This article addresses a significant topic for many couples and individuals looking to expand their families: how to afford IVF. In Vitro Fertilization (IVF) is a complex and often expensive procedure, which can create barriers for those eager to conceive. Understanding the financial aspects of IVF can help in making informed decisions that can lead to successful parenthood. Our aim is to provide clarity and resources on managing the costs of IVF, making this crucial journey more accessible for everyone who needs it.

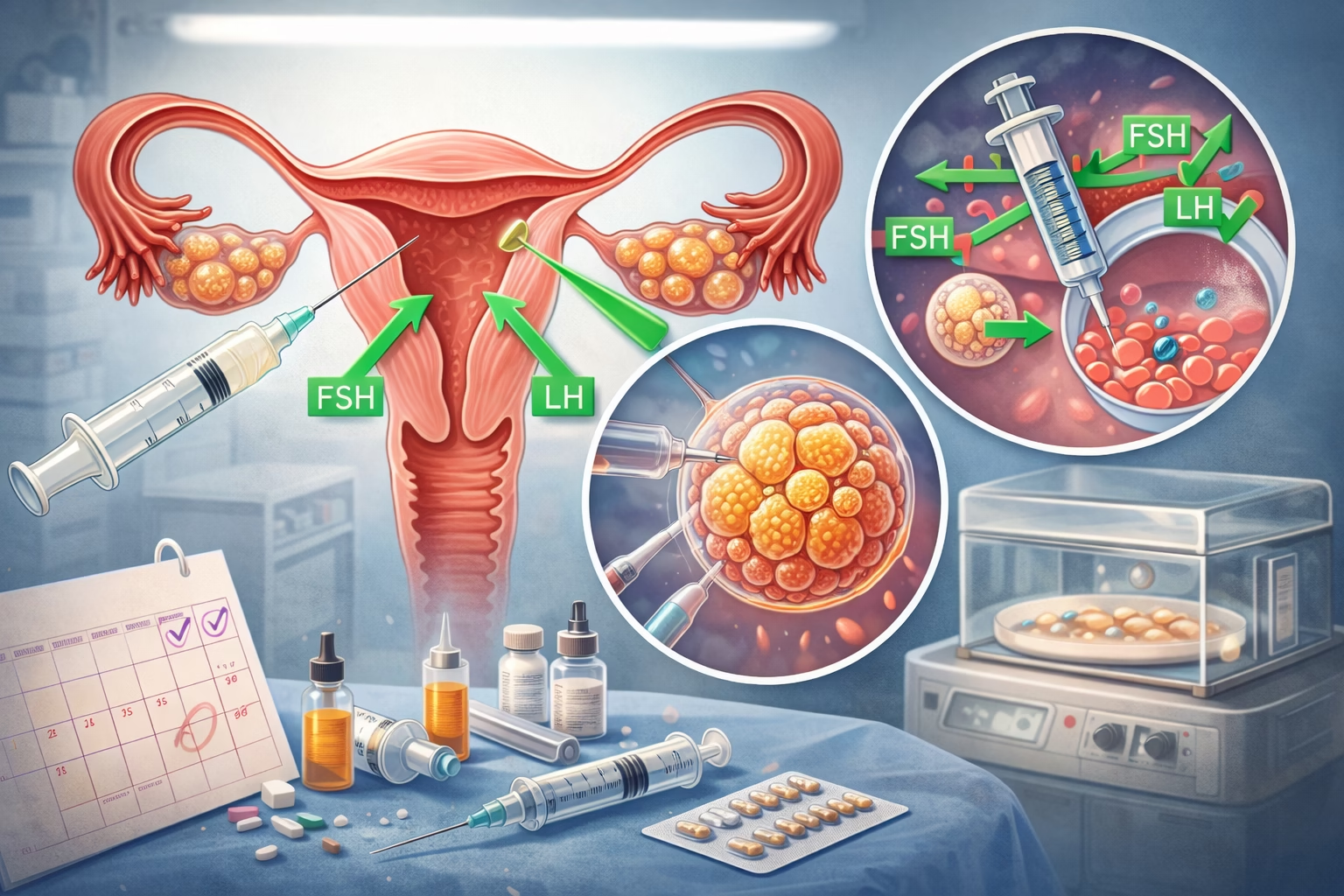

IVF refers to the process of fertilizing an egg with sperm outside the body, in a laboratory setting. This method is often the last resort for couples struggling with infertility due to various reasons such as age, medical conditions, or unexplained infertility. The steps to IVF include ovarian stimulation, egg retrieval, fertilization, embryo culture, and embryo transfer. As promising as this process is, one main hurdle appears to be the financial aspect. The cost of treatment can be overwhelming, leading many to wonder how they can afford IVF. Understanding this complexity will equip potential parents with valuable information to navigate their financial paths toward successful treatment.

Understanding IVF Costs

The first step in managing IVF expenses is to fully grasp what influences the overall cost. The financial burden of IVF varies widely based on several factors, including geographical location, clinic selection, the individual’s health insurance coverage, and the specific protocols used during treatment. A comprehensive understanding will allow individuals to strategize effectively.

Generally, the expenses tied to IVF include medication, laboratory fees, consultations, and any necessary procedures. Medication costs can vary significantly, with some women needing more than others, based on their response to hormonal treatments. Additionally, geographical location plays a crucial role, as cities with a higher cost of living may charge more for these services. The choice of clinic can also impact expenses; opting for a facility with a higher success rate or advanced technology could cost more but might result in better outcomes.

Considering these aspects will allow potential patients to assess their budgets while factoring in additional expenses that can emerge during the IVF journey. Making informed decisions about where to receive treatment can significantly affect overall costs.

Health Insurance Coverage

Health insurance coverage can dramatically affect how to afford IVF treatments. Depending on the insurance policy, individuals may receive partial or full coverage for IVF-related procedures. It is crucial to investigate any coverage available through employers, government programs, or personal health plans. Each plan differs, and understanding the exact terms is vital for budgeting.

Some states have mandates requiring insurance companies to cover IVF treatments. Additionally, some insurance policies have lifetime maximums for fertility treatments. Reviewing these stipulations will help individuals lay out a financial plan and reduce unexpected costs along the way. Awareness of one’s health benefits will make it much easier to prepare financially for the IVF process and can lead to substantial savings.

Payment Plans & Financing Options

Many clinics recognize the financial burden of IVF and offer payment plans or financing options to make the process more manageable. These plans can spread the cost over time, making it easier for couples to pursue treatment without the immediate, full financial commitment. Researching clinics that provide flexible payment options can significantly help in relieving some financial stress.

Furthermore, financing options can include loans specifically geared towards medical treatments. There are organizations and financial institutions that specialize in loans for fertility treatments, which might come with favorable terms and lower interest rates compared to credit cards. Understanding these payment structures and options is essential to navigate how to afford IVF effectively. Patients should be proactive by discussing payment structures during their initial consultation to identify a plan that suits their financial situation.

Grants and Financial Assistance Programs

Various financial assistance programs offer support for couples pursuing IVF. These grants are often provided by non-profits or fertility organizations dedicated to helping those struggling with infertility. Each program has specific eligibility requirements, so individuals should invest the time to research thoroughly and apply where applicable.

Researching such options is worthwhile as they can significantly offset treatment costs. Some grants cover a percentage of the treatment or reimburse patients after completion. Familiarizing oneself with potential programs can offer a glimmer of hope for many couples hesitating due to financial concerns. Taking the initiative to apply for these grants could be a significant step towards achieving one’s dream of parenthood.

Local Fertility Clinics and Costs

The cost of IVF can vary greatly from one clinic to another, even within the same geographical location. Searching for regional fertility clinics allows individuals to compare costs and services. Investigating the success rates of local clinics will also provide insight into whether the cost aligns with quality care.

When considering local options, it is important to remember that affordability should not come at the expense of reduced quality of care. Investigating why a clinic’s prices may be lower than average can prevent potential patients from making poor choices about their reproductive health. Getting consultations and understanding how their fees align with their success rates aids in weighing the cost against benefits.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

Utilizing Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) can offer substantial tax advantages when it comes to IVF expenses. These accounts enable individuals to set aside pre-tax income specifically for medical expenses, potentially saving a significant amount over time.

By allocating funds to these accounts before tax deductions, couples can reduce the overall cost burden of IVF treatments. Familiarizing oneself with these financial tools can be a vital factor that should be part of the planning process. Each tax year, it is important to consider how tax breaks and savings can contribute positively to affording necessary medical treatments.

Understanding Medication Costs

Medications play a significant role in the IVF process, and understanding their costs can help individuals plan their budgets effectively. Medications used in IVF are necessary to stimulate the ovaries to ensure that multiple eggs are produced. These medications can quickly add up, so being aware of their prices is paramount.

Patients are encouraged to discuss their medication options with their healthcare providers, as there may be alternatives available that can lessen costs without compromising care. Additionally, purchasing medications from mail-order pharmacies can sometimes reduce costs further. Always inquire about generic options and pricing during consultations, as these factors substantially influence the overall treatment expense.

Travel Considerations

For individuals living in areas with limited access to IVF services, traveling to a clinic may be necessary. While travel often adds to the cost, sometimes, it can be in patients’ best financial interests due to lower treatment costs in other locations. Additionally, some clinics provide special packages for patients traveling for treatment, potentially reducing expenses further.

When traveling for treatment, it is crucial to budget for travel expenses, accommodation, and any additional costs. Careful planning can minimize surprises, allowing patients to concentrate on their main objective—successful IVF treatment.

Final Thoughts

Affording IVF can indeed be a complex and daunting challenge, yet with careful planning, individuals and couples can navigate the financial landscape more effectively. Each person’s journey is unique, tailored to their circumstances, but integrating the steps outlined above will empower individuals to make informed decisions that can significantly ease the financial burden.

Health insurance coverage, payment options, grants, local clinic investigations, and utilization of medical savings accounts all present various avenues to reduce costs associated with IVF. Each option requires due diligence and proactive measures, but the goal remains the same—the dream of parenthood, made possible by accessing the necessary treatments.

In conclusion, understanding how to afford IVF hinges on taking the time to explore available options, planning wisely, and utilizing resources to ease the financial strain. Awareness and research will create opportunities to pursue one’s goal of becoming a parent, ensuring hopeful individuals are not deterred by the possible expenses of necessary treatments.

FAQs

The average cost varies significantly depending on location and clinic, but it can range from $12,000 to $15,000 per cycle without insurance coverage.

Some insurance plans do cover IVF, while others do not or have limited coverage. It is essential to check with your specific plan to understand your benefits.

Yes, many non-profits and organizations offer grants that can help offset the costs associated with IVF. Researching available grants is a beneficial step.

Yes, you can use funds from both FSA and HSA to pay for IVF expenses, as these accounts allow you to set aside pre-tax money for medical costs.

Several factors influence IVF costs, including the clinic chosen, medications needed, geographical location, and whether institutional or laboratory fees apply.

Further Reading

What Type of Psychotherapy Is Best for Anxiety?