In this article, we will be talking about the possibilities and implications of using an HSA (Health Savings Account) for IVF (In Vitro Fertilization) treatments. Understanding HSA benefits can be crucial for couples seeking fertility treatments. Many individuals are unaware that they may use their HSA funds for medical expenses involving IVF. The following sections will clarify what HSAs are, their associated benefits, and how they relate to covering IVF costs.

An HSA is a tax-advantaged savings account designed for individuals with high-deductible health plans (HDHPs). Contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This account can be utilized to cover various medical expenses, thereby reducing out-of-pocket costs for healthcare services, including surgeries, medications, and fertility treatments such as IVF. Due to the rising costs of IVF, which often range from $10,000 to $15,000 per cycle, using an HSA can significantly alleviate the financial burden on individuals and couples striving to build their families. It’s essential to determine eligibility and understand what qualifies as acceptable medical expenses under the Internal Revenue Service regulations.

Understanding HSA Basics

Health Savings Accounts provide an avenue for individuals to save money for medical expenses while enjoying tax advantages. Contributions made to an HSA are tax-deductible, which reduces taxable income. These funds can be used tax-free for qualified medical expenses, including various treatments and procedures.

To qualify for an HSA, one must be enrolled in a high-deductible health plan. This means that the annual deductible must meet minimum thresholds set by the IRS. There are contribution limits for HSAs that may change yearly, so it is beneficial to stay informed. Any unused funds in the HSA roll over to the following year, making it easier to save for future medical costs.

HSA funds can be utilized for various medical expenses, such as routine checkups, emergency services, hospital stays, and prescription medications. Importantly, costs related to fertility treatments like IVF also fall under these qualified expenses, provided that the treatments are deemed medically necessary.

Coverage of IVF Treatments

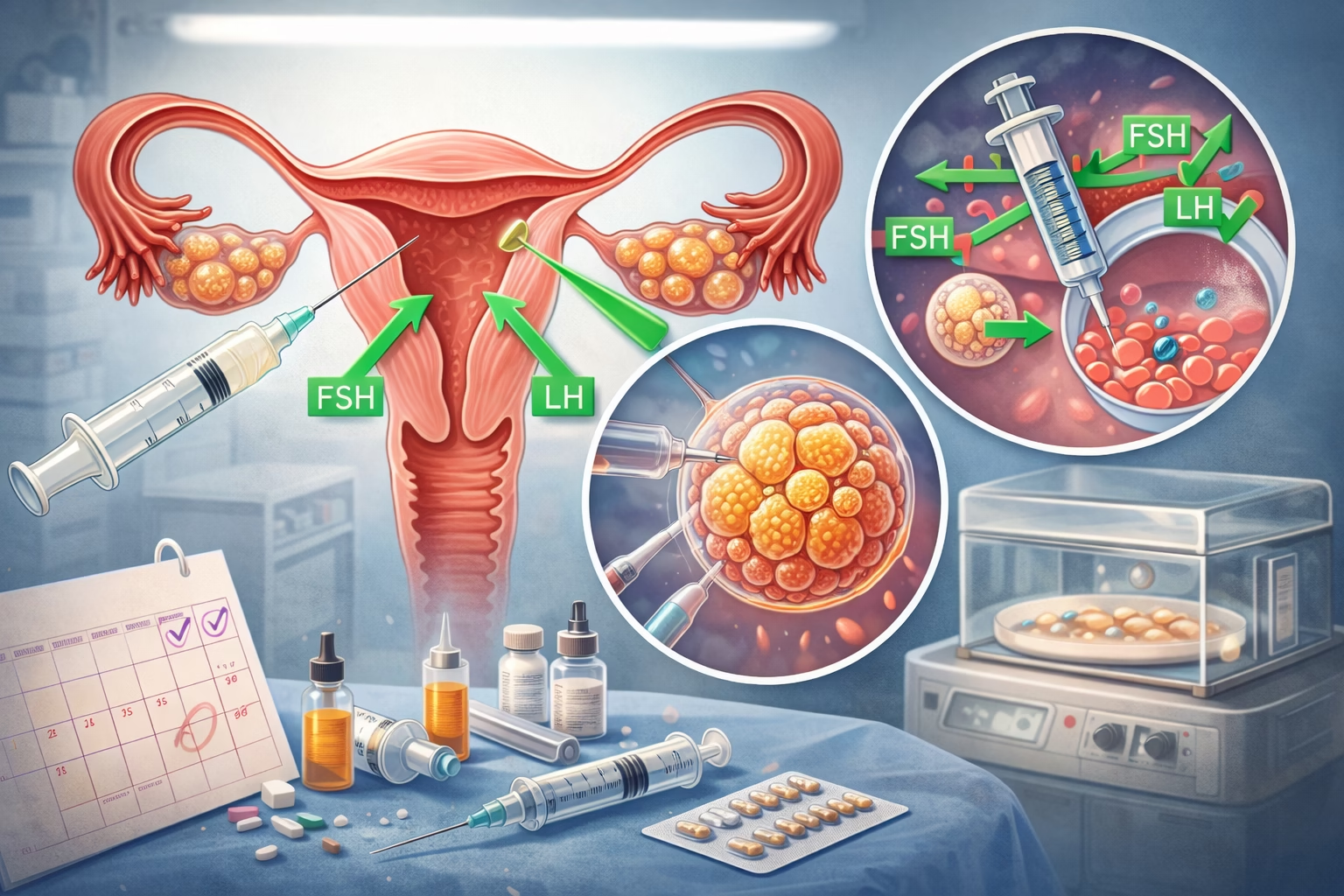

Many individuals do not realize that IVF can be covered under HSA funds. In vitro fertilization is often a necessary option for couples facing infertility challenges. It typically involves multiple steps, including ovulation stimulation, egg retrieval, fertilization, and embryo transfer, making it a significant financial commitment.

The IRS does not specifically list IVF as a covered expense, but it does allow for the use of HSA funds for medical procedures deemed medically necessary. Many healthcare professionals recognize IVF as such, providing the necessary documentation for HSA withdrawal. Couples seeking to use HSA funds for IVF should gather all relevant records, including diagnosis and treatment plans, to ensure that account administrators approve these expenditures.

Utilizing HSA funds for IVF not only helps cover the financial burden but can also make a difficult process slightly more manageable. Couples should check with their HSA administrator to understand what documentation is required and to uncover any limitations specific to their accounts.

Potential HSA Tax Advantages

The tax advantages of HSAs present another compelling reason to utilize these accounts for IVF expenses. Contributions made to HSAs are tax-deductible, which can reduce the overall tax burden. Additionally, money withdrawn for qualified medical expenses, such as IVF, does not incur income tax.

One key benefit is the triple tax advantage: contributions are tax-deductible, the account earns tax-free interest, and withdrawals for qualified medical expenses also remain tax-free. This presents an excellent opportunity for individuals and couples using their HSA during fertility treatment cycles, minimizing their financial strain while maximizing their potential for successful treatment.

It’s essential to keep detailed records of all expenses and contributions related to the HSA to ensure compliance and maximize tax benefits. In some cases, consulting a tax professional is advisable for personalized insights regarding HCAs and IVF expenditures.

Eligibility and Contribution Limits

Eligibility requirements for HSAs stipulate that individuals must be enrolled in a high-deductible health plan. As of 2023, the minimum deductible limits for these plans are set annually by the IRS. Both individual and family plans have differing contribution limits.

For 2023, individuals can contribute up to a specified limit, while families may contribute a higher amount. These contribution limits are subject to change, and being aware of current regulations ensures you are contributing the maximum allowable amount.

It is also important to note that individuals above a certain age (55 and older) can make additional “catch-up” contributions to their HSA, which can further assist in saving for significant medical expenses such as IVF.

Documenting Medical Expenses

Proper documentation is pivotal when utilizing HSA funds for IVF treatments. Receipts and invoices serve as vital proof for expenditures related to fertility treatment. This documentation is crucial for both the individual using the HSA and the account administrator to ensure that funds are used appropriately.

When submitting claims or withdrawing funds, providing accurate and thorough documentation of all medical expenses not only streamlines the process but can also prevent potential complications later on. Treatments that qualify under IRS guidelines typically require proof of medical necessity, and having the right documents readily available makes managing finances much easier throughout the IVF process.

Making the Most of Your HSA

To maximize the benefits of an HSA for IVF treatments, it’s advisable to plan and budget accordingly. Start by estimating the total costs associated with the IVF cycle and setting aside the necessary funds. Knowing the treatment schedule and timeline can help financially prepare for required payments.

Consider using a combination of HSA funds along with personal savings or other financial resources to cover the overall costs. This multi-faceted approach enables better cash flow management throughout the process.

Educating oneself on how HSAs work and the specific rules regarding qualified medical expenses can help avoid disappointments or misunderstandings during the withdrawal process. Taking proactive measures can make the entire experience smoother and less stressful, allowing couples to focus on their fertility journeys instead of finances.

Final Thoughts

In summary, utilizing an HSA for IVF treatments offers a valuable financial strategy for couples aiming to achieve their dream of parenthood. Understanding the tax advantages and proper documentation needed can make a big difference in managing the costs associated with IVF.

As HSAs provide the triple tax advantage of tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, they present an attractive option for couples facing fertility challenges. By being aware of eligibility requirements, contribution limits, and documentation needs, individuals can effectively navigate their finances during the IVF process.

It’s essential to remember that while money may not alleviate the emotional challenges faced during infertility, having the financial aspect organized can relieve some stress. Consult with healthcare and financial professionals for personalized advice, and ensure that all expenses are accounted for when utilizing HSA funds.

Seeking treatment for infertility is often a challenging road filled with emotional highs and lows. However, being informed about available options such as HSAs can empower couples to make more effective decisions regarding their fertility journey.

Frequently Asked Questions

Yes, you can use HSA funds for IVF expenses as long as the treatment is deemed medically necessary.

You will need to provide thorough documentation, including invoices and proof of medical necessity.

If audited, you will need to show evidence of qualifying expenses and proof that the funds were used for eligible IVF treatments.

Yes, contribution limits are set yearly by the IRS, so you should stay updated on those figures.

You should consult with your healthcare provider to confirm that the treatment is medically necessary and ensure you have the appropriate documentation.

Further Reading

What Type of Psychotherapy Is Best for Anxiety?