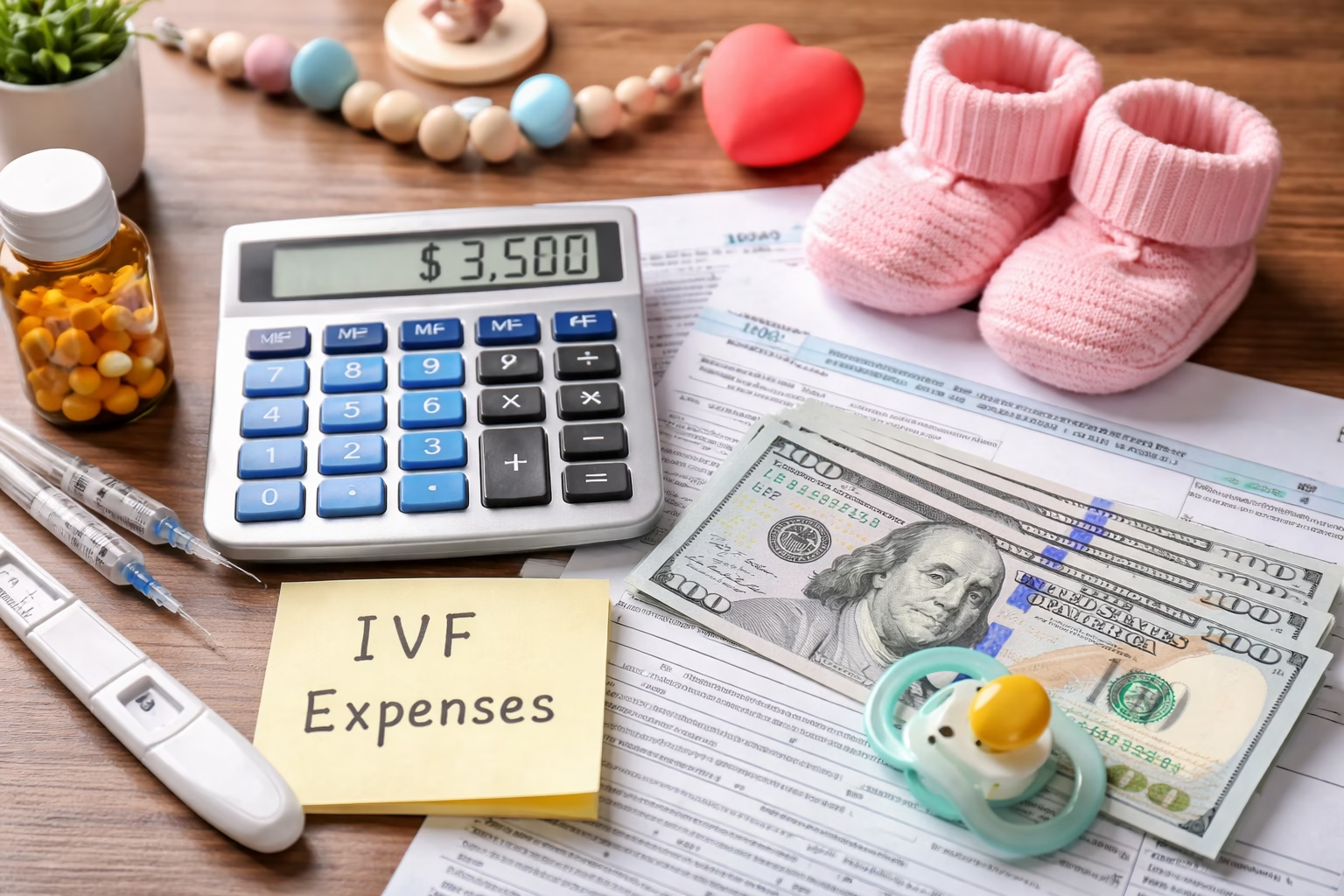

We will be talking about IVF loans for bad credit. In vitro fertilization (IVF) is an assisted reproductive technology that has helped countless couples achieve their dream of parenthood. However, the costs associated with IVF can be prohibitive, sometimes exceeding tens of thousands of dollars. As such, couples may find themselves looking for financial assistance to cover these medical expenses. This is where IVF loans come into play. For individuals or couples with bad credit, securing loans can be challenging due to their financial history. However, there are options available specifically tailored to support those who need funding for IVF treatments. Understanding the nature of these loans, how to qualify for them, and the complications often associated with bad credit is essential for couples in need of financial help. This comprehensive guide aims to provide the information necessary to navigate through IVF loans for bad credit, ensuring that everyone can have the opportunity to build their family.

Understanding the Basics of IVF Loans

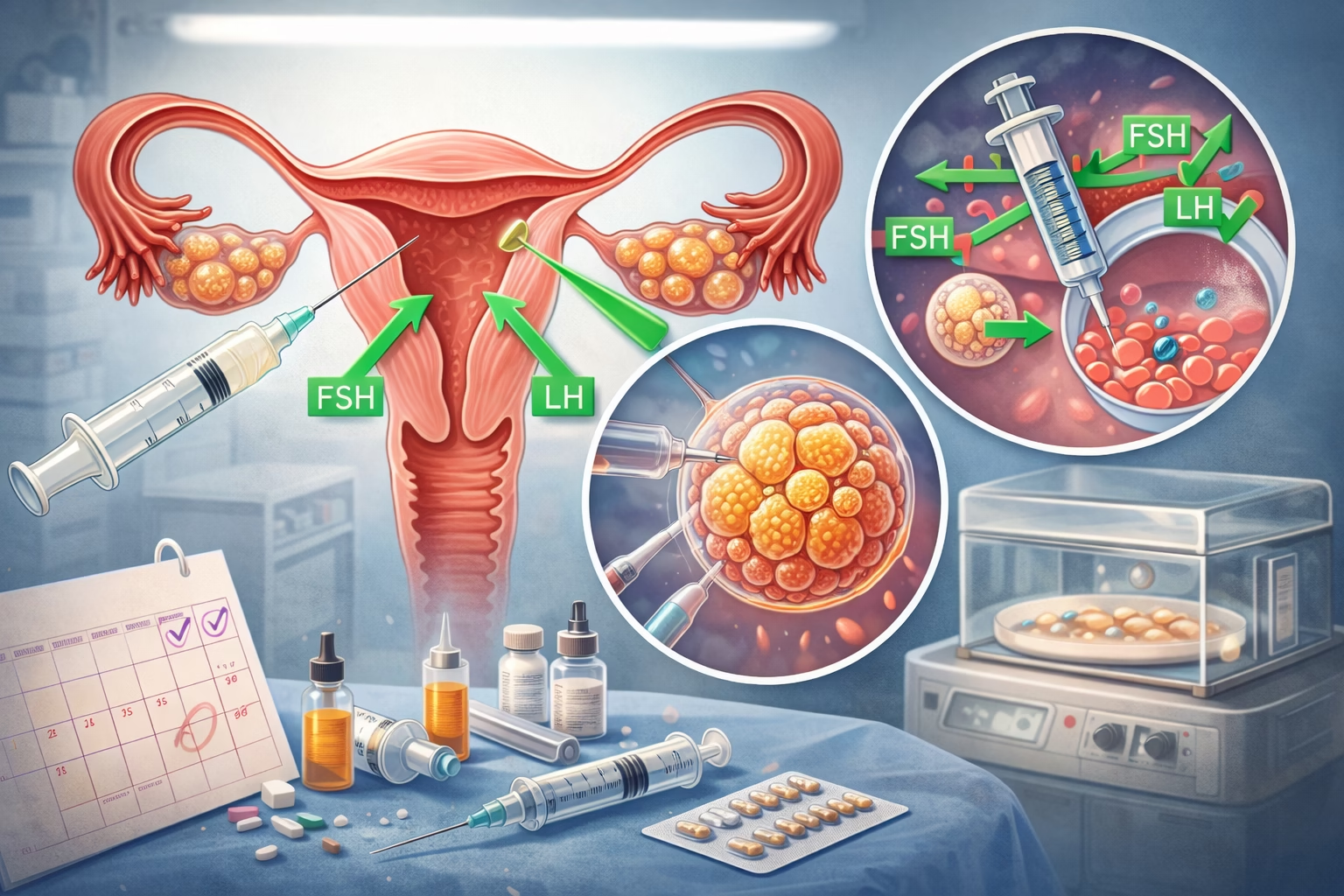

IVF loans are specialized loan products aimed at financing the expense of in vitro fertilization and other fertility treatments. These loans allow couples to cover the significant costs associated with procedures, medications, and necessary diagnostics. Unlike traditional loans, which often require excellent credit for approval, IVF loans are more flexible in their requirements. This flexibility is crucial for individuals who may have faced financial hardships in the past and have resulting negative credit scores.

It is important to note that while IVF loans can help smooth the financial burden, they are still loans that need to be repaid. The repayment terms can vary widely based on the lender and the borrower’s financial situation. Some lenders may offer favorable interest rates and repayment plans designed to accommodate individuals with less-than-ideal credit histories.

Before opting for IVF loans, individuals are encouraged to thoroughly compare lenders, interest rates, and loan terms to ensure they make informed financial decisions. Understanding the full scope of the costs of IVF and how loans fit into that picture is essential for successful treatment.

The Importance of Good Credit

Good credit significantly impacts one’s ability to secure loans of any type, including IVF loans. Lenders often assess credit scores to determine not only eligibility but also the interest rate and loan terms. For couples considering IVF, awareness of their credit scores and the factors that affect them can provide a clearer picture of what financing options are available.

A healthy credit score demonstrates to lenders that the borrower is financially responsible, minimizing the perceived risk. However, many people face challenges that can lead to a lower credit score, including job loss, medical bills, or unexpected life changes.

Individuals interested in IVF loans should take proactive steps to improve their credit scores before applying, including:

Taking these steps may help secure better loan terms, which can ease the financial strain of IVF treatments.

Options for Bad Credit

For individuals and couples with bad credit, securing financing can feel overwhelming. However, there are various options tailored to those who may not meet conventional credit standards. Some specific avenues include:

It is important for individuals to conduct thorough research and compare these options for interest rates, terms, and fees. Many specialized lenders understand the challenges associated with fertility treatments and may offer flexible payment plans, making it easier to manage monthly payments.

Understanding Loan Terms

When considering IVF loans for bad credit, it is crucial to understand the key terms that come with these financial products. Borrowers can benefit from familiarizing themselves with the following terms:

Understanding these terms helps borrowers make informed decisions. A transparent understanding of the loan structure can lessen anxiety about the financial obligations associated with IVF treatments. Additionally, clear comprehension of loan terms ensures borrowers are aware of any additional fees or penalties that might arise.

Potential Pitfalls and Considerations

While seeking IVF loans can be beneficial, potential borrowers should be aware of some common pitfalls. These include:

Before choosing a loan option, individuals should carefully read all of the fine print. They should seek clarification from the lender regarding any uncertainties regarding terms, fees, and repayment. Additionally, individuals should consider their financial situations realistically and ensure that the loan can be supported by their income without causing undue stress or hardship.

Repayment Strategies

After securing IVF loans, it is essential to establish effective repayment strategies. Having a plan helps maintain healthy finances and ensures that payments are made consistently and on time. Some strategies include:

By developing a structured plan for repayment, individuals can manage their loan obligations while continuing to focus on their fertility journey. A proactive approach not only minimizes stress but can also improve credit scores as payments are made on time.

Emotional and Psychological Factors

Financing fertility treatments can bring about emotional and psychological challenges for individuals. Couples often experience anxiety about their financial situation in addition to the stress associated with fertility treatments. It is essential to prioritize mental wellness alongside financial decisions. This may include:

Emotional health plays an important role in the success of fertility treatments. A strong support system can provide couples with the strength and resilience needed to navigate the path to parenthood. By addressing both financial and emotional health, couples can create a more balanced approach to their fertility journey.

Final Thoughts

IVF loans for bad credit offer hope and opportunities for couples who wish to pursue in vitro fertilization despite financial challenges. Understanding the financing process, loan options, and managing repayment are crucial for making informed decisions about fertility treatments. While securing loans with bad credit may seem daunting, specialized lenders provide valuable avenues for financial assistance. Taking proactive steps to improve credit, understanding loan terms, and creating effective repayment strategies can lead the way to a successful fertility journey.

Having a complete picture allows couples to focus on what truly matters: building their family. With proper financial planning and support, achieving parenthood becomes a more feasible goal. Exploring options available for those with bad credit empowers individuals to make informed choices that can ultimately lead to the fulfillment of their dreams.

Frequently Asked Questions

IVF loans are financial products specifically designed to cover the expenses related to in vitro fertilization and other fertility treatments.

Yes, there are specialized lenders that provide IVF loans specifically for individuals with bad credit. These lenders typically have more flexible requirements.

Common terms include principal, interest rate, loan term, and monthly payments. Understanding these terms helps borrowers navigate their loan options effectively.

Improving credit can be achieved by paying bills on time, reducing outstanding debts, checking credit reports for errors, and minimizing new credit inquiries.

Consider interest rates, repayment terms, fees, prepayment penalties, and the reputation of the lender when comparing loan options.

Further Reading

What Type of Psychotherapy Is Best for Anxiety?