We will be talking about IVF tax credit. This topic is crucial for individuals or couples seeking fertility treatments because IVF (In Vitro Fertilization) can be incredibly costly. Understanding tax credits associated with IVF can significantly alleviate financial burdens. The IVF tax credit refers to the tax preferences that certain individuals may qualify for when they incur expenses related to IVF treatments. Depending on one’s location, both federal and state tax credits may be available to assist with the expenses of IVF. This can include laboratory and physician fees for fertility treatments, medication expenses, and other related costs. Given the high costs of IVF procedures, which can easily ascend to tens of thousands of dollars, knowing about the potential tax credits offers substantial financial relief. Awareness and preparation for how these tax credits work, eligibility criteria, and how to maximize the benefits can help prospective parents ease the financial stresses associated with fertility treatments.

Understanding IVF Expenses

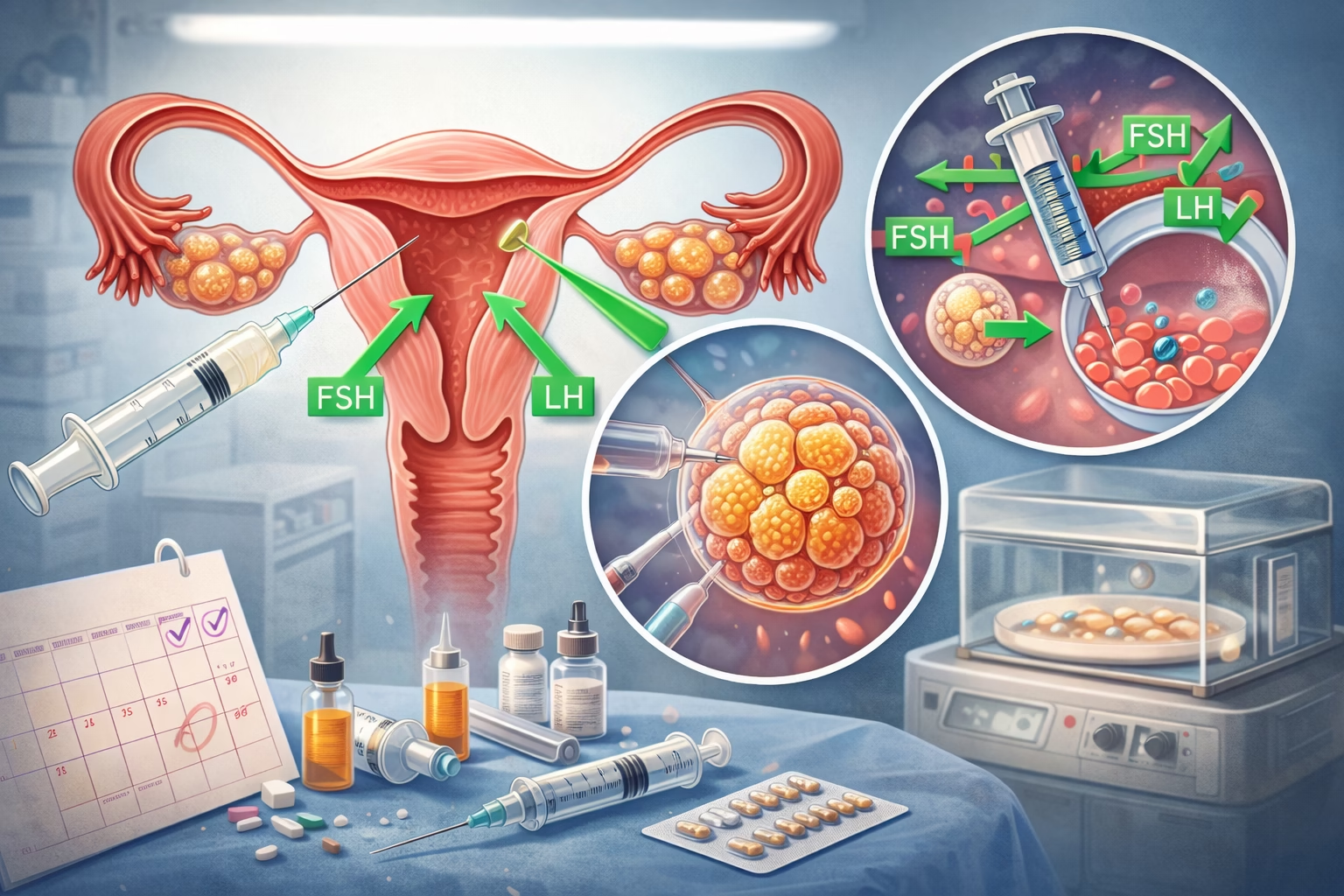

To fully appreciate the relevance of the IVF tax credit, it is crucial to understand the multiple expenses associated with In Vitro Fertilization. The IVF process involves several treatments and medication types over various stages, all of which contribute to the overall costs.

Here are the most common expenses incurred during the IVF journey:

- Initial consultation fees with fertility specialists.

- Ultrasounds and blood tests to monitor hormone levels.

- Costs of egg retrieval and sperm collection.

- Laboratory fees for fertilization and embryo culture.

- Embryo transfer procedures.

- Medications for ovarian stimulation and hormone supplements.

- Potential additional costs like pre-implantation genetic testing.

Understanding each of these components can help you identify which specific costs may qualify for tax credits. The more informed you are about your expenses, the better you can utilize available tax credits.

Eligibility for IVF Tax Credit

Not everyone qualifies for IVF tax credits. There are specific eligibility criteria that applicants must meet to utilize this tax relief effectively. Generally, both federal and state tax regulations have different standards to determine qualifying expenses.

Typically, you must meet the following criteria:

- You must have incurred expenses related to legally recognized medical treatments.

- The IVF treatments must take place within a certain tax year.

- Documentation, including invoices and receipts, must be meticulously maintained.

- Filing status and income may also affect eligibility.

Understanding and meeting these eligibility requirements is vital to ensuring you can claim the IVF tax credit. Always consult with a tax professional who is familiar with fertility treatment expenses.

Types of IVF Tax Credits

Tax credits can come in various forms, and understanding what is available can maximize your financial outcomes. Many states and the federal government offer different types of tax credits and deductions related to IVF.

Some common types of credits for IVF treatments include:

- Federal Medical Expense Tax Deduction: If your total medical expenses exceed a certain percentage of your adjusted gross income, you may deduct these costs from your taxable income.

- State-specific Tax Credits: Some states provide direct tax credits for IVF-related costs outside the federal scope. These may vary substantially from state to state.

- Health Savings Accounts (HSA): Contributions made to HSAs can often be used for IVF expenses, providing another route for tax savings.

A thorough review of available credits and how they can work hand-in-hand is advisable for comprehensive financial planning. Researching each option will empower you to understand your potential savings.

Filing Taxes with IVF Expenses

Filing your taxes while managing IVF expenses can be challenging, but specific strategies can make this process less tedious. Documentation is paramount; maintaining clear and organized records will simplify filing.

to facilitate the filing process:

- Keep all receipts and invoices from IVF treatments and medications.

- Document consultation and procedure dates for specific tax years.

- Be prepared to provide health insurance statements that detail covered expenses.

- Consider consultation with a tax professional who specializes in medical expenses.

Each tax year can bring new developments; current regulations and credit opportunities must be reviewed each time you file taxes. Knowledge of any changes that could affect your returns is beneficial.

Maximizing Your Tax Credit Benefits

To gain the most from your IVF tax credits, proactive strategies will be essential. Tax planning ahead of time is the best way to maximize your benefits through available credits.

Here are some methods to consider:

- Check limitations and thresholds for your state and federal credits.

- Review contributions to health savings accounts that will provide additional savings.

- Consult tax experts experienced in medical expenses to ensure all eligible costs are included.

- Consider other tax-favored accounts for fertility treatments, such as flexible spending accounts.

Proactive measures around the timing of treatments can also affect tax outcomes, especially if you can manage costs to claim them all in one tax year.

Common Misconceptions About IVF Tax Credits

Misunderstandings surrounding IVF tax credits can lead to lost opportunities. Recognizing and addressing these misconceptions can help individuals navigate the complexities of claiming these credits successfully.

Some common misconceptions include:

- All IVF treatments are fully tax-deductible, which is not correctly the case.

- You cannot use tax credits if you have insurance coverage that partially pays for IVF.

- The paperwork is too complex and not worth the effort, though proper documentation can simplify this process greatly.

- Tax credits always apply to every individual, whereas specific conditions can dictate who is eligible.

Educating yourself about these misconceptions eliminates confusion and ensures you leverage all available financial resources.

Future of IVF Tax Credits

The landscape for IVF tax credits continues to evolve, influenced by changes in healthcare policies and tax laws. Understanding these changes is important for prospective parents looking to benefit from IVF treatments.

Emerging trends shaping the future may include:

- Increased advocacy for broader coverage and recognition of IVF expenses in tax law.

- Potential updates to existing tax credits that expand eligibility requirements.

- Changes on a state level that could lead to more accessible information about IVF tax relief.

- Shifts in insurance company policies regarding coverage rates for fertility treatments, including IVF.

Continuous monitoring of these developments will keep you informed and prepared for future opportunities that could arise.

Final Thoughts

Understanding the IVF tax credit can offer significant financial relief to prospective parents navigating the challenges of fertility treatments. This comprehensive discussion elucidates various aspects related to the topic, helping individuals become more informed about potential benefits.

From understanding the costs associated with IVF, eligibility criteria for receiving tax credits, and the types of available credits, to strategies for maximizing benefits and addressing common misconceptions, the information provided allows you to approach tax season with confidence. Given the high costs of IVF treatments, knowing how to reduce financial strain can make the journey towards parenthood more manageable.

Keeping abreast of the filing process and leveraging tax strategies, along with staying alert to emerging trends and changes in tax laws, enables individuals to make well-informed financial decisions throughout their IVF journey. The hopeful prospects of parenthood can be supported by understanding these financial aids, resulting in a more positive experience overall.

Frequently Asked Questions

1. What expenses qualify for the IVF tax credit?

Eligible expenses often include laboratory fees, medication costs, consultation fees, and expenses related to other fertility treatment procedures.

2. Do both federal and state tax credits exist?

Yes, several states offer their own tax credits in addition to the federal ones; the specifics will depend on your state of residence.

3. How do I file for the IVF tax credit?

Carefully maintain all related receipts, complete the applicable tax forms, and consult a tax professional to ensure proper filing.

4. Do I need to keep documentation for all my IVF expenses?

Yes, retaining all invoices and receipts is essential for claiming the credits effectively.

5. Are there any future changes expected for IVF tax credits?

While changes can occur, remaining informed about shifts in tax laws can help you prepare for any new credits or changes in eligibility requirements.

Further Reading

What Type of Psychotherapy Is Best for Anxiety?