We will be discussing a significant financial aspect regarding in vitro fertilization (IVF): can you write off IVF on taxes? This query emerges frequently among couples exploring fertility treatments. It is essential to understand that IVF treatments can be costly, often hitting tens of thousands of dollars. Therefore, understanding how to leverage tax deductions related to IVF can provide considerable financial relief, assisting in managing these significant expenses.

In this article, we will explain what it means to write off IVF on taxes. A tax write-off allows taxpayers to reduce their taxable income with particular medical expenses. When it comes to IVF, the IRS categorizes it as a qualified medical expense, which might be tax-deductible based on certain criteria. However, the eligibility for such deductions requires proper documentation and an understanding of IRS rules. This detailed examination aims to illuminate whether and how to officially write off IVF on taxes while ensuring compliance with tax regulations.

Understanding IVF and Its Costs

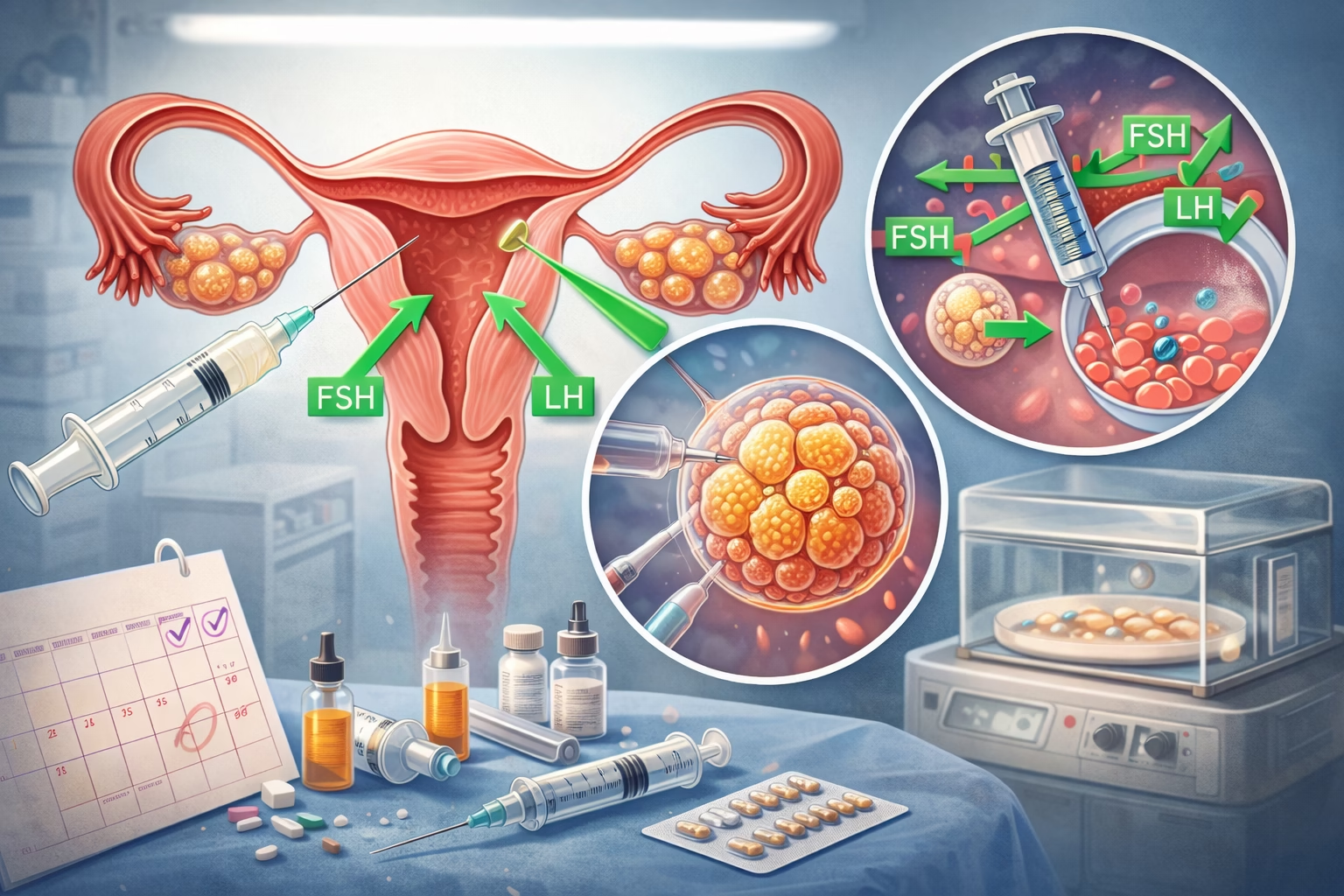

In vitro fertilization is a fertility treatment that involves extracting eggs, retrieving sperm, and combining them in a laboratory to facilitate fertilization. This process is typically pursued when couples face challenges with natural conception. The cost of IVF can range from $10,000 to $15,000 per cycle, not including medications, which can substantially increase the overall expense. In many cases, multiple cycles are needed to achieve a successful pregnancy, creating a financial burden that prompts many to seek tax deductions.

Due to the high costs associated with IVF, financial planning becomes crucial. Many individuals often express a desire to gain insight into the tax benefits available to them. Understanding these costs not only includes fertilization but also factors in laboratory fees, medical consultations, and associated medications. This comprehensive knowledge can guide couples in making informed financial decisions related to their fertility journeys.

What is a Medical Tax Deduction?

A medical tax deduction allows taxpayers to deduct qualified medical expenses from their taxable income, potentially leading to a lower tax bill. For the tax year, you can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). This percentage is important as it dictates how much of your medical expenses, including IVF treatments, can be written off.

The IRS recognizes a variety of expenses as necessary for treatment. When considering IVF, the costs directly related to the procedure, such as the IVF treatment itself and accompanying medications, typically fall under qualifying expenses. However, patients must keep detailed records and work closely with a tax advisor to understand their specific tax situation.

Eligibility Criteria for IVF Tax Deductions

To qualify for a tax deduction for IVF expenses, certain eligibility criteria must be met. Primarily, expenses must be documented properly and must exceed the specified percentage of AGI. Furthermore, individuals must itemize their deductions on their tax forms, which means they cannot take the standard deduction available to all taxpayers.

The patient’s status also plays a role. Married couples filing jointly may find it easier to exceed the 7.5% threshold than single taxpayers. This complexity indicates that financial planning should involve consultations with tax professionals who can provide guidance on maximizing potential deductions.

Documenting IVF Expenses for Tax Deductions

Proper documentation is essential for claiming tax deductions related to IVF treatments. All expenses, including consultations, medications, and procedures, must be tracked meticulously. This includes retaining receipts and invoices as evidence of expenditures. Besides, creating a detailed record of treatments received and associated costs can simplify the process during tax season.

In addition to receipts, obtaining documentation regarding the necessity of specific treatments may be beneficial. This can include letters from medical professionals or clinics involved in the IVF process. Such documentation supports the legitimacy of the expenses claimed on tax returns.

Filing for Tax Deductions on IVF Expenses

Filing for tax deductions on IVF expenses can be straightforward if the proper steps are followed. Begin by itemizing deductions on Schedule A of Form 1040. You will then need to accurately report all qualifying medical expenses, ensuring they surpass the 7.5% AGI threshold.

It is crucial to consult a tax professional or use reliable tax software to ensure you are filing correctly. Getting expert advice will make a significant difference in maximizing your deductions while maintaining compliance with current IRS regulations. The advice from professionals can make this entire process less overwhelming and more beneficial.

Maximizing Tax Benefits Related to IVF Treatments

There are various strategies to maximize tax benefits related to IVF treatments. Aside from the standard deduction, families can also explore flexible spending accounts (FSAs) or health savings accounts (HSAs) that allow expenses associated with IVF to be paid using pre-tax dollars.

Using these accounts can provide significant savings opportunities, as they lower your taxable income. Furthermore, with planning, couples can align their procedures to ensure they take full advantage of the most favorable tax treatments available for their situations. Congratulations can indeed be transformed into financial savings if managed wisely.

Impact of Changes in Tax Law on IVF Write-Offs

Tax laws are subject to change, and it is important to keep informed about updates that could affect your ability to write off IVF expenses. The IRS revises rules occasionally, which could alter thresholds or the types of expenses that qualify. Staying updated can save taxpayers from unexpected costs and frustrations. The insight gained from working with tax professionals can alert couples about any impending changes and provide guidance on how to adapt their financial planning accordingly.

Common Misconceptions Regarding IVF Tax Write-Offs

There are several misconceptions related to the ability to write off IVF treatments on taxes. For instance, many people believe that all expenses incurred during the IVF process are fully deductible. However, only expenses that exceed the AGI percentage will qualify.

Additionally, misunderstandings about eligibility criteria often lead individuals to overlook potential deductions. Regular conversations with tax advisors can help clear up these misconceptions and provide accurate information that leads to fiscal benefits for families undergoing IVF treatments.

Conclusion

In conclusion, understanding the ins and outs of whether you can write off IVF on taxes is essential for anyone pursuing this fertility treatment. With the substantial costs associated with IVF, financial relief through tax deductions could make a significant difference in a couple’s fertility journey. Armed with the right information, couples can confidently navigate their tax situations, ensuring they maximize available deductions. Always remember, proper documentation and consultation with tax professionals will pave the way for claiming applicable deductions effectively and efficiently. Staying informed about changes in tax laws is equally important, enabling individuals to adapt their financial strategies as necessary.

5 Frequently Asked Questions (FAQs):

- Can I write off all IVF expenses on my taxes? Not all expenses are deductible; only those that exceed 7.5% of your AGI improve chances of deduction.

- Do I need to itemize deductions to write off IVF? Yes, you must itemize deductions on your tax return to claim IVF expenses.

- Are medications used in IVF deductible? Yes, medications related to IVF are considered qualified medical expenses and can be deducted.

- Is there a specific tax form for reporting IVF expenses? You will report qualified expenses using Schedule A (Form 1040).

- Should I keep records of my IVF expenses? Yes, maintaining thorough documentation, including receipts and invoices, is crucial for claiming deductions.

Further Reading

What Type of Psychotherapy Is Best for Anxiety?